The Income Tax Bill 2025, introduced earlier this year to replace the six-decade-old Income Tax Act of 1961, has been officially withdrawn from the Lok Sabha. The move is part of the government’s effort to avoid confusion caused by multiple versions of the Bill and to present a clear, updated draft that incorporates key recommendations from the Parliamentary Select Committee.

The new Income Tax Bill 2025 will be tabled in Parliament on Monday, August 11, 2025. According to the Finance Ministry, this revised draft will simplify the tax code, reduce legal complexities, and offer significant relief to middle-class taxpayers and small businesses.

Why the Income Tax Bill 2025 Was Withdrawn

The government’s decision to have the Income Tax Bill 2025 withdrawn comes after an in-depth review by the 31-member Select Committee, chaired by BJP MP Baijayant Jay Panda.

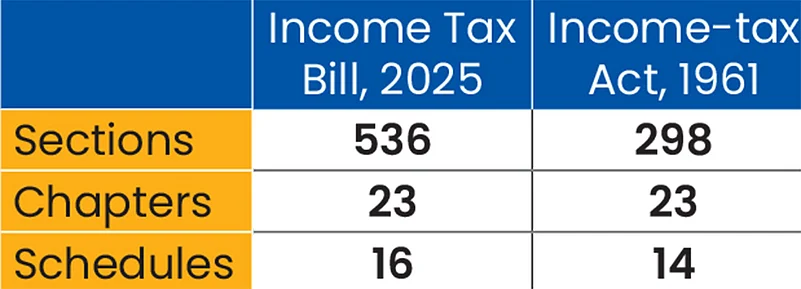

The earlier version, introduced on February 13, 2025, aimed to modernize India’s direct tax system. However, with more than 4,000 amendments and over 5 lakh words, the Income Tax Act of 1961 had become too cumbersome for the average taxpayer to navigate.

Mr. Panda explained that the new Income Tax Bill 2025 will reduce the bulk of the law by nearly 50%, making it easier for individuals and MSMEs to understand and comply without heavy dependence on legal or financial experts.

Background: Why a New Income Tax Bill Was Needed

India’s current income tax framework was established in 1961. Over the decades, frequent amendments were made to keep up with economic changes, inflation, and global trade policies. While these amendments addressed immediate issues, they also made the law lengthy and difficult for non-experts to understand.

The new Income Tax Bill 2025 is being positioned as a once-in-a-generation reform that can make taxation simpler, more transparent, and fairer for both individuals and businesses.

Key Features of the New Income Tax Bill 2025

The upcoming bill is designed to simplify taxation while ensuring fairness and transparency. Here’s what you can expect:

1. Simplified Tax Structure

The revised draft will remove outdated provisions, merge similar sections, and make the language more accessible to non-specialists.

2. Middle-Class Relief

Tax slabs and rates are being restructured to reduce the burden on working families.

- Rebate threshold increased: Under Section 87A of the new tax regime, the limit will rise from ₹7 lakh to ₹12 lakh.

- Rebate amount increased: Maximum rebate raised from ₹25,000 to ₹60,000.

3. Marginal Relief

To ensure fairness, marginal relief will apply for incomes just above ₹12 lakh, preventing sudden tax spikes.

4. Benefits for MSMEs

Small businesses will enjoy simpler compliance, reduced litigation risk, and fewer complex forms to file.

Additional Provisions Expected in the Bill

The new Income Tax Bill 2025 is likely to include:

- 30% standard deduction on house property income retained in law.

- Home loan interest deduction extended to rented properties, not just self-occupied homes.

- Faster TDS/TCS refunds with more transparency under CBDT’s “Enforcement with Empathy” approach.

These measures will encourage investment, promote ease of doing business, and increase disposable income for households.

Public Reaction

Tax experts have welcomed the move, calling it a much-needed step towards modernizing India’s tax regime. Many small business owners believe that simplifying the Income Tax Bill will reduce their compliance costs and free up resources for growth. Middle-class taxpayers are particularly optimistic about the increased rebate limit, which will leave them with more disposable income for savings and household spending.

Government’s Assurances to Taxpayers

The Finance Ministry has emphasized that there will be no additional direct tax burden on the working or middle-class population. Instead, the new structure will boost savings, encourage spending, and support long-term economic growth.

Key Highlights

| Topic | Details |

|---|---|

| Bill Withdrawn Date | August 8, 2025 |

| New Bill Introduction | August 11, 2025 |

| Main Reason | Avoid confusion, integrate recommendations, simplify tax code |

| Focus Groups | Middle-class taxpayers, MSMEs, small business owners |

| Key Benefits | Higher rebate limit, simpler rules, reduced compliance burden |

What’s Next?

Once tabled, the new Income Tax Bill 2025 will undergo debate and voting in the Lok Sabha before moving to the Rajya Sabha. If passed, it will replace the current law and be implemented in the upcoming financial year.

Taxpayers can expect simpler filing processes, reduced paperwork, and more money in their pockets — a welcome change after decades of complicated tax laws.