India is standing at a critical economic crossroads in 2025. On one side, Trump’s 50% tariffs on Indian exports are creating hurdles for trade, jobs, and industrial growth. On the other, the Indian government’s sweeping GST 2.0 reform, slashing rates on daily essentials and consumer goods, aims to inject new life into the domestic economy.

The big question: Will GST rate cuts be enough to counter Trump’s 50% tariffs and keep India’s GDP growth on track?

GST 2.0 Reform: What’s Changing?

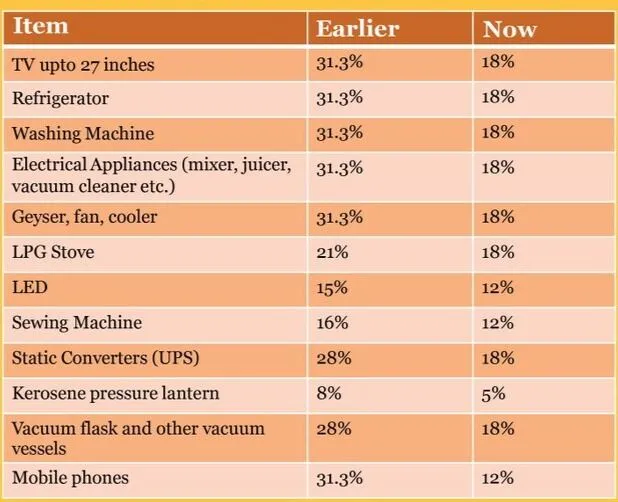

The Goods and Services Tax (GST) was long criticized for being too complicated. Now, GST 2.0 simplifies the tax regime, offering relief for both businesses and consumers:

- Two main tax slabs: 5% and 18% (down from four slabs earlier).

- Daily essentials like soap, toothpaste, shampoo, and packaged food are taxed at just 5%.

- Big-ticket consumer goods—like cars, electronics, cement, and hotel stays under ₹7,500—are down to 18% instead of 28%.

- Luxury and sin goods (alcohol, cigarettes, luxury vehicles) continue at a special 40% cess.

- Health and life insurance premiums are now GST-exempt, giving middle-class families direct financial relief.

- Effective Date: September 22, 2025, timed with Navratri and Diwali festivals to maximize consumer spending.

This reform is designed as a festival gift for consumers, boosting demand in the short run while making compliance easier for businesses.

How GST Rate Cuts Can Boost India’s GDP Growth

1. Rising Consumer Spending

Households account for over 60% of India’s GDP through private consumption. Lower GST rates mean families will spend more on essentials and discretionary items, directly pushing GDP upward.

2. Encouraging Small Businesses

Reduced rates cut compliance burdens for small and medium businesses, which form the backbone of India’s economy. More liquidity means they can expand, hire, and produce at larger scales.

3. Cooling Inflation

By reducing the GST on essentials and key industrial inputs, inflation may cool by up to 1.1 percentage points, giving the Reserve Bank of India (RBI) room to maintain a supportive monetary policy.

4. Stock Market Rally

Auto, FMCG, and consumer goods stocks already surged after the announcement. A confident stock market boosts investor sentiment and encourages foreign investments.

The Threat of Trump’s 50% Tariffs

While GST cuts are positive, India cannot ignore the elephant in the room: Trump’s 50% tariffs on Indian exports.

- Export impact: Labor-intensive sectors like textiles, gems, jewelry, and leather goods are hit hardest.

- GDP drag: Economists estimate the tariffs could shave 0.6–0.8 percentage points off India’s GDP in FY2025–26.

- Jobs at risk: Millions of workers in export-oriented industries face uncertain futures.

- Trade imbalance: India may have to look towards the EU, Middle East, and Southeast Asia to diversify export markets.

Can GST Rate Cuts Offset Tariff Losses?

The consensus among economists is that GST reforms can partly—but not fully—offset the damage from Trump’s tariffs.

- GDP Growth Boost: GST reforms could add 0.6–1.2 percentage points to GDP growth.

- Tariff Drag: U.S. tariffs are expected to cut 0.6–0.8 percentage points.

- Net Effect: India may still see a net positive impact of up to 0.4 percentage points, depending on how quickly domestic demand picks up.

Fiscal Challenges for India

There’s no free lunch—these GST cuts will cost the government around ₹48,000 crore ($5–6 billion) in lost tax revenue.

- The Centre loses more, while some states may gain due to higher consumption.

- Fiscal deficit risks: The government must balance growth stimulus with fiscal discipline.

- If consumption picks up strongly, the revenue shortfall could be offset by higher GST collections from volumes.

Why Timing Matters

Launching GST 2.0 in September 2025 is strategic:

- The festive season (Navratri to Diwali) is when Indians spend the most.

- Early relief for households gives a psychological boost, encouraging them to loosen their wallets.

- Political angle: With elections around the corner, the government also secures goodwill from the middle class.

Long-Term Outlook for Indian Economy 2025

- If domestic demand surges, India could still clock 7%+ GDP growth in FY26 despite global trade headwinds.

- However, export dependency remains a vulnerability, and tariffs show how fragile external markets can be.

- India will need to diversify its trade partners and invest more in domestic manufacturing to reduce over-reliance on the U.S.

FAQs: GST 2.0 and Trump’s 50% Tariffs

Q1. What is GST 2.0?

GST 2.0 is India’s new tax reform simplifying GST slabs to 5% and 18%, cutting rates on essentials and consumer goods to boost demand.

Q2. When will GST 2.0 come into effect?

GST 2.0 will be effective from September 22, 2025, just before Navratri and Diwali.

Q3. Why did India cut GST rates now?

To stimulate domestic demand, reduce inflation, and cushion the economy against Trump’s 50% tariffs on Indian exports.

Q4. How will Trump’s 50% tariffs affect India?

They will hit export industries like textiles and jewelry, reduce GDP growth by up to 0.8%, and impact jobs in export sectors.

Q5. Can GST cuts fully counter the tariffs?

Not fully. GST reforms may boost GDP by up to 1.2%, while tariffs cut 0.8%. The net effect could still be positive but limited.

Q6. What are the risks of GST cuts?

The main risk is fiscal strain, with the government losing around ₹48,000 crore in tax revenue. However, higher consumption could partly balance this.

Final Thoughts

The battle between GST rate cuts and Trump’s 50% tariffs will shape India’s economic story in 2025. While tariffs threaten exports, GST 2.0 empowers domestic consumers and businesses. If implemented effectively, India can not only weather the trade storm but also emerge with stronger internal demand, keeping India’s GDP growth steady above 7%.