If you’ve been shopping in Canada recently, you might have noticed a subtle but welcome change—prices aren’t rising as fast as they used to. Inflation in Canada has dropped to 2%, the lowest level in over three years. This is big news not just for economists and policymakers, but for everyday Canadians who feel the pinch at the grocery store, gas station, and checkout counter.

For many people, inflation is more than just a number—it’s what makes your morning coffee cost a little more each month or forces you to rethink that new car purchase. So when inflation slows down, it’s a sign that things are stabilizing. Let’s dive into what this means for you, how we got here, and what comes next.

Inflation Hits Lowest Level in Years

| Key Insight | Details |

|---|---|

| Latest Inflation Rate | 2% (as of August 2024) – lowest since February 2021 |

| Previous Rate | 2.5% in July 2024 |

| Long-Term Trend | Inflation averaged around 2% for 25 years before the pandemic |

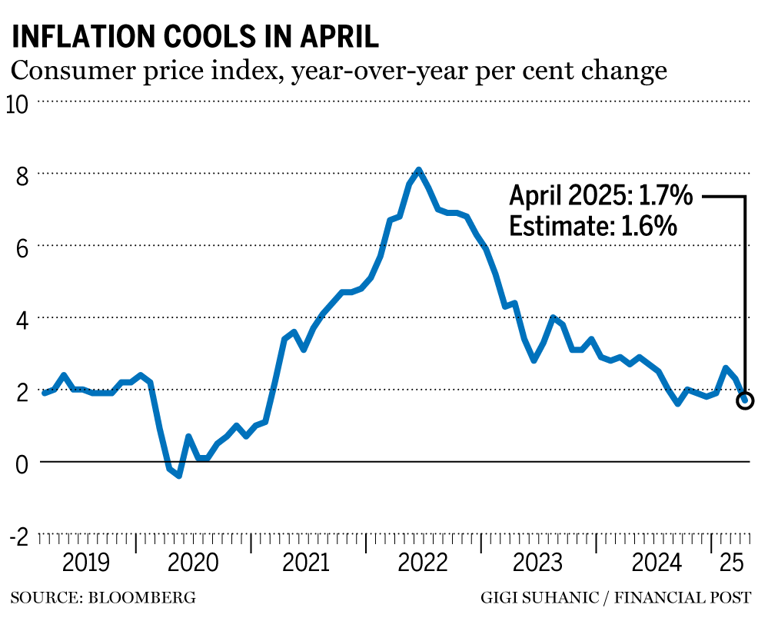

| Peak During Pandemic | Surged above 8% in 2022 due to supply chain issues and demand shocks |

| Main Contributing Factor | Lower gasoline prices and stabilized food costs |

| Impact on Consumers | Reduced pressure on household budgets, potential for interest rate cuts |

| What You Can Do | Review your budget, consider refinancing loans, and stay informed about future economic trends |

The drop in inflation to 2% is a positive sign for Canadian shoppers, businesses, and the overall economy. It reflects the success of central bank policies and improved global conditions. For everyday Canadians, this means more predictable prices, potential savings at the pump, and opportunities to re-evaluate finances. While challenges remain, this milestone offers hope and stability after years of uncertainty.

What Is Inflation—and Why Should You Care?

Let’s start with the basics. Inflation is the rate at which prices for goods and services rise over time. When inflation is high, your money doesn’t go as far—you can buy less with the same amount. When inflation is low or stable, your purchasing power stays stronger.

Think of it like this: imagine your favorite ice cream shop raised the price of a cone from $3 to $6 overnight. That’s extreme inflation. But if the price only went up by a few cents each year, that’s manageable—like the kind of slow inflation we’re seeing now.

June SSI Payments: When’s the Check Coming? A Simple Guide to My Social Security and the SSA

How Does Canada Measure Inflation?

Canada uses the Consumer Price Index (CPI) to track inflation. The CPI measures how much a basket of everyday goods and services—like groceries, rent, transportation, and utilities—costs compared to the previous year.

This basket includes hundreds of items, and Statistics Canada updates it regularly to reflect how Canadians actually spend their money.

A Look Back: From Stable Prices to Pandemic Surge

Before the pandemic, inflation in Canada was pretty predictable. For nearly 25 years, it hovered around the 2% target set by the Bank of Canada. Life felt somewhat stable—your salary could keep pace with rising costs, and budgeting wasn’t too stressful.

Then came 2020 and 2021. The global pandemic disrupted supply chains, factories shut down, shipping slowed, and demand for certain products skyrocketed. Suddenly, everything from toilet paper to electronics became harder to get—and more expensive.

By 2022, inflation hit over 8%, the highest in decades. People were paying significantly more for essentials like food, gas, and housing. The Bank of Canada responded by raising interest rates to cool spending and borrowing.

The Good News: Inflation Drops to 2%

Fast forward to today: inflation has returned to 2% as of August 2024—the first time it’s been this low since early 2021. That’s great news for consumers and businesses alike.

According to Statistics Canada, the drop was largely driven by lower energy prices, especially gasoline. Food prices also began to stabilize after months of steep increases.

Here’s a quick snapshot:

- Gasoline prices: Down 7.5% year-over-year

- Food prices: Rose just 1.9% in August vs. over 10% earlier in 2023

- Core inflation (excluding volatile items): Also trending downward

This cooling trend suggests that the Bank of Canada’s strategy is working. But what does it mean for your wallet?

How This Affects Canadian Shoppers

When inflation drops, it usually translates into some relief for households. Here’s how this development impacts different areas of your life:

1. Grocery Shopping Gets Easier

Food prices had been rising sharply, especially for staples like bread, eggs, and milk. Now, those increases are slowing. While prices aren’t going back down yet, they’re not climbing as fast either.

Example: If you were spending $500/month on groceries last year, you may now only see small increases instead of jumps of $50 or more.

2. Cheaper Gas = More Spending Power

Lower gasoline prices mean more money in your pocket. If you drive daily, this could save you hundreds of dollars per month—money you can use for savings, travel, or other needs.

3. Potential for Interest Rate Cuts

With inflation under control, the Bank of Canada may begin cutting interest rates. That means:

- Lower mortgage payments (especially for variable-rate mortgages)

- Cheaper car loans

- Better deals on credit card balances and personal loans

4. More Stability for Businesses

Businesses benefit too. With slower inflation, companies can plan better, invest more confidently, and maybe even offer raises without worrying about rising costs eating into profits.

Why Did Inflation Drop? Breaking Down the Causes

The return to 2% didn’t happen overnight. It was the result of several key factors:

Falling Energy Prices

Gasoline prices are a major component of inflation. As global oil prices cooled and supply stabilized, so did fuel costs at the pump.

Slower Food Inflation

After years of sharp increases, food prices are finally slowing down. This is partly due to better harvests, fewer supply chain disruptions, and more competition among retailers.

Higher Interest Rates Worked

The Bank of Canada raised interest rates aggressively starting in 2022. These hikes made borrowing more expensive, which slowed consumer spending and business investment—helping to reduce inflationary pressure.

Global Economic Slowdown

Weaker demand globally, especially from China and Europe, also helped ease inflation. Less global demand means less upward pressure on commodity prices.

What This Means for Your Money

Now that inflation is under control, there are several ways you can take advantage of this shift:

1. Revisit Your Budget

With prices stabilizing, it’s a good time to reassess your monthly expenses. Maybe you can allocate more toward savings or investments.

2. Consider Refinancing

If you have a variable-rate mortgage or high-interest debt, look into locking in a lower rate now before potential rate cuts.

3. Watch for Retail Promotions

Retailers often respond to falling inflation by offering more discounts and promotions. Keep an eye out for sales, especially during seasonal events like back-to-school or Black Friday.

4. Stay Informed About Rate Changes

Interest rate decisions affect everything from mortgages to savings accounts. Follow updates from the Bank of Canada or consult a financial advisor to make smart moves.

Looking Ahead: Will Inflation Stay Low?

While the current 2% figure is encouraging, experts caution that inflation could still fluctuate depending on global events, wage growth, and policy changes.

However, most analysts expect inflation to remain near the target for the rest of 2024 and into 2025, assuming no major shocks occur.

The Bank of Canada will continue monitoring key indicators like employment, wage growth, and housing market trends before making further decisions on interest rates.

Shocking Changes in the 2025 Income Tax Bill: Are You Prepared to Save Big or Lose It All?

Frequently Asked Questions (FAQ)

What is inflation?

Inflation is the rate at which the general level of prices for goods and services rises over time, reducing your purchasing power.

Why is 2% the target for inflation in Canada?

A moderate level of inflation helps encourage spending and investment while avoiding deflation (falling prices). The Bank of Canada targets 2% as part of its monetary policy to ensure economic stability.

Does lower inflation mean prices are dropping?

Not necessarily. Lower inflation means prices are still rising, but more slowly. Deflation is when prices actually fall.

How does inflation affect my savings?

High inflation reduces the value of your savings over time. With lower inflation, your money retains its value better.

Are interest rates going down?

Possibly. With inflation hitting the target, the Bank of Canada may consider lowering interest rates to stimulate the economy.

Should I adjust my investment strategy?

It’s always wise to review your investments with a financial advisor. Lower inflation often leads to more stable markets and better returns on certain assets like bonds.