India’s digital economy has been on a fast track, driven by the rise of UPI and the vision of leaders like Shloka Ambani who continue to champion cashless growth. However, recent developments show that the road to a digital-first economy is facing resistance from the ground.

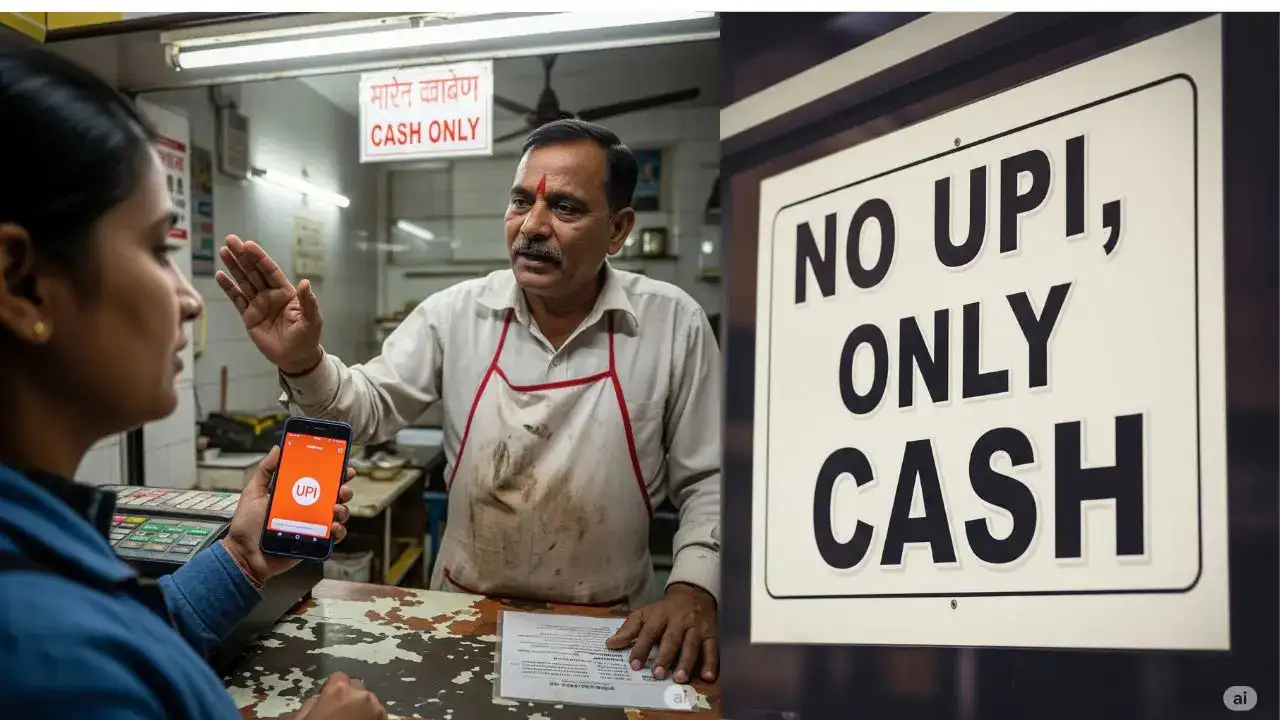

Across cities like Bengaluru and beyond, small retailers and shopkeepers are increasingly displaying signs like “No UPI – Only Cash.” This growing trend of UPI rejection by small merchants has triggered serious questions about the GST impact on digital payments and whether the government has pushed too far, too fast.

UPI was meant to empower—offering fast, secure, zero-cost payments to merchants and consumers. Over 300 million users have adopted UPI, and it has helped India reach a digital transaction value of ₹260 trillion in FY2025. But now, the same merchants who embraced UPI are rejecting it due to unexpected tax bills based on their digital transactions.

GST Overreach and Merchant Backlash

Many of these small merchants originally operated below the ₹40 lakh turnover threshold for GST and were legally exempt. But now, state governments are allegedly using UPI transaction data to issue consolidated GST notices—even to those who never registered for GST voluntarily.

The result is a major backlash. Small vendors feel misled. UPI was free, easy, and popular. It helped them avoid change shortages and long queues. But with GST enforcement creeping in through digital records, the same tool has now become a liability.

Shloka Ambani, as a key advocate of digital transformation through platforms like Jio and Reliance Retail, has been instrumental in pushing India’s digital agenda. However, if small businesses begin to exit the ecosystem, the effectiveness of that vision is at risk.

Digital Promises vs Ground Reality

While government policies have favored digital transactions, the implementation of indirect tax collection through those transactions is causing panic among small and medium physical merchants. Many argue they have not seen higher income or customer volumes through UPI. What started as a convenience is now seen as surveillance.

Relevant reading: Reliance Q1 FY26 Profit Surges 76 Percent

What History Teaches Us

In the United States, income tax took decades to normalize. Initially, less than 1% of people complied. Only after simplified systems like withholding tax and minimum thresholds were introduced did voluntary compliance grow. India may need a similar approach.

Implementing an Alternative Minimum Tax (AMT)—a small, automatic, digitally deducted levy—could replace complicated GST filings for small vendors. It would be universal, simple, and not feel like punishment.

Small Merchants Feel Targeted

In some states, particularly those not politically aligned with the Centre, small vendors claim they are being unfairly targeted to make up for revenue shortfalls. Local GST officers are pressuring shop owners with UPI transaction records, leading many to disable QR codes, disable apps, or even shut down their UPI accounts.

Additional insight: Canada Digital Adoption Program vs US Chips Act

RBI’s Mixed Signals

Interestingly, while merchants are rejecting UPI due to tax concerns, the RBI has ordered banks to load more low-denomination notes in ATMs to ensure easier access to cash. This could further encourage a return to cash-based transactions.

What Needs to Be Done

To reverse the growing distrust among small merchants, the government could:

- Simplify GST registration and compliance

- Introduce a fixed low-rate AMT linked to digital payments

- Provide clarity on how UPI data is being used

- Share tax revenue with payment ecosystem players to maintain digital momentum

Final Thoughts

The UPI rejection by small merchants is a warning sign that India’s digital growth is not as inclusive as it appears. While Shloka Ambani and other leaders promote a connected, cashless economy, the ground reality shows that the system must be more balanced and fair.

Without reforms, the GST impact on digital payments may slow down UPI adoption and hurt the very merchants who were supposed to benefit from digitization.

Further reading:

TCS Q1 FY26 Profit Share Price

Perplexity Pro Airtel Free Access Worth Rs17000

PM Awas Yojana 2025 Apply Online New List

NVIDIA Stock AI Chip Sales to China

Southend Airport Plane Crashes London

FAQs

Q1. Why are small merchants rejecting UPI?

Because UPI transaction data is now being used to assess GST, even for merchants who were previously exempt.

Q2. What is Shloka Ambani’s role in India’s digital transformation?

As part of Reliance and a public advocate of digital growth, Shloka Ambani represents India’s ambition for a fully digitized economy.

Q3. How is GST affecting digital payments?

State officials are allegedly using UPI data to raise GST demands, creating fear and mistrust among small business owners.

Q4. What is an AMT and how can it help?

An Alternative Minimum Tax (AMT) is a simple, automatic levy that can make tax collection easier and more acceptable for small merchants.

Q5. Will the RBI’s cash push impact UPI growth?

Yes, as cash becomes easier to access, merchants may continue moving away from UPI until policy clarity returns.